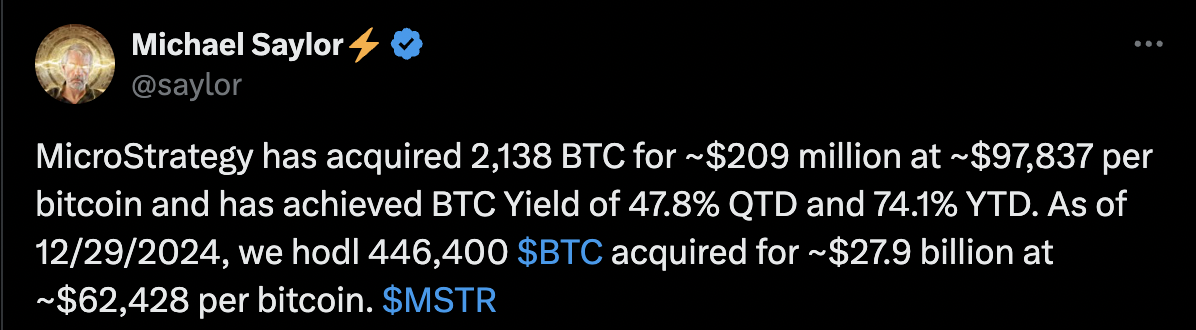

MicroStrategy, renowned for its steadfast commitment to Bitcoin, continues to actively grow its cryptocurrency reserves. Today, the company acquired an additional 2,138 BTC for a total of $209 million, with an average purchase price of $97,837 per coin.

Currently, MicroStrategy holds 446,400 BTC on its balance sheet, valued at $27.9 billion. The average acquisition price stands at $62,428 per Bitcoin.

MicroStrategy ranks 57th in the Nasdaq 100 Index, with a market share of 0.38%. This tech company has made Bitcoin not only a cornerstone of its investment strategy but also an integral part of its corporate identity, showcasing the synergy between traditional business operations and digital assets.

The company's financial performance speaks volumes. Quarterly investment returns increased by 47.8%, while annual returns grew by 74.1%.

Recently, MicroStrategy climbed to the 97th position among the top 100 U.S. public companies. This achievement was fueled by a 12% rise in its stock price, which reached $430 per share. The stock surge coincided with Bitcoin reaching an all-time high, underscoring the effectiveness of the company’s chosen strategy.

Why It Matters

MicroStrategy stands as a prominent example of a company confidently integrating cryptocurrency into its business model. Its success inspires other market participants and demonstrates that investments in digital assets can be a powerful growth tool, even in highly competitive environments.