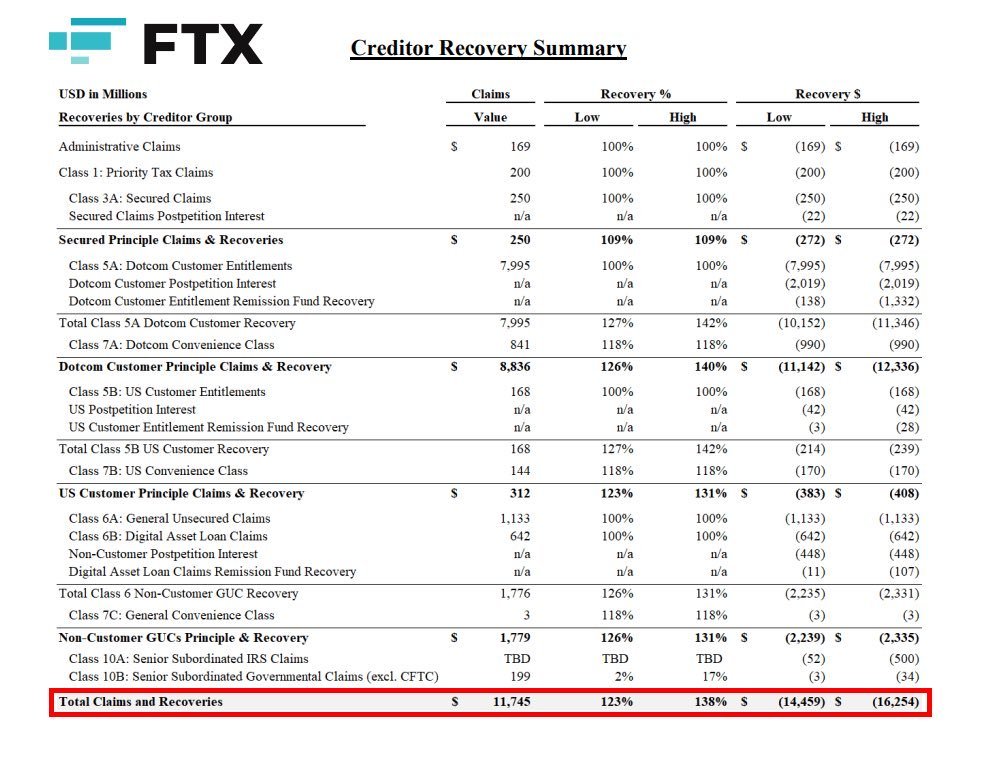

FTX will begin paying creditors $16 billion starting January 3, 2025, with $12 billion of the total to be disbursed in stablecoins through Kraken and BitGo.

FTX is preparing to compensate its creditors, announcing the start date as January 3, 2025. The total repayment of $16 billion includes $12 billion in stablecoins, which will be distributed through platforms like Kraken and BitGo. The payment process will span 60 days, ensuring a phased return of funds.

Key details to know:

Start of payments: Creditors will begin receiving their funds in early 2025. The payments will be distributed over two months.

Impact on the market: It is anticipated that the return of funds in cryptocurrency could become a major driver of market growth. This may enhance liquidity and stimulate activity among participants.

Boost to the next growth cycle: The potential inflow of significant amounts into the cryptocurrency market could trigger a new wave of growth in 2025. However, there are concerns about possible asset sales prior to the beginning of repayments.

What might happen?

Some experts suggest that FTX may need to liquidate assets to ensure dollar payouts. However, this is unlikely for key cryptocurrencies like Bitcoin or Ethereum, as the company held only a small portion of these assets. Instead, the sale is more likely to involve less popular tokens. Additionally, there is a possibility that part of the assets has already been converted into fiat.

Positive impact on the market

Overall, the situation appears quite promising for the cryptocurrency ecosystem. The inflow of $16 billion could occur without significant market pressure, and a portion of the funds is likely to be reinvested into digital assets. Investors may view this as an opportunity for long-term growth, as a significant share of the returned funds could flow back into cryptocurrencies, supporting key assets and contributing to market stability.

As 2025 approaches, the crypto community eagerly follows developments surrounding FTX. Transparency in implementing this process will be a crucial factor in further strengthening trust and market stability.