Argentine President’s Meme Coin LIBRA Drops 99%: Scandal and Possible Impeachment

16 Feb 2025

On February 15, 2025, Argentina’s President Javier Milei unexpectedly announced the launch of a new meme coin called LIBRA, built on the Solana blockchain. This move generated significant buzz in the crypto community and caused the asset’s value to soar: the coin’s market capitalization reached $4.5 billion within just a few hours.

However, the market was soon stunned by a drastic 99% drop. At the time of writing, the token’s price remains around $0.23, and many analysts link this dramatic decline to potential manipulations by the project’s developers.

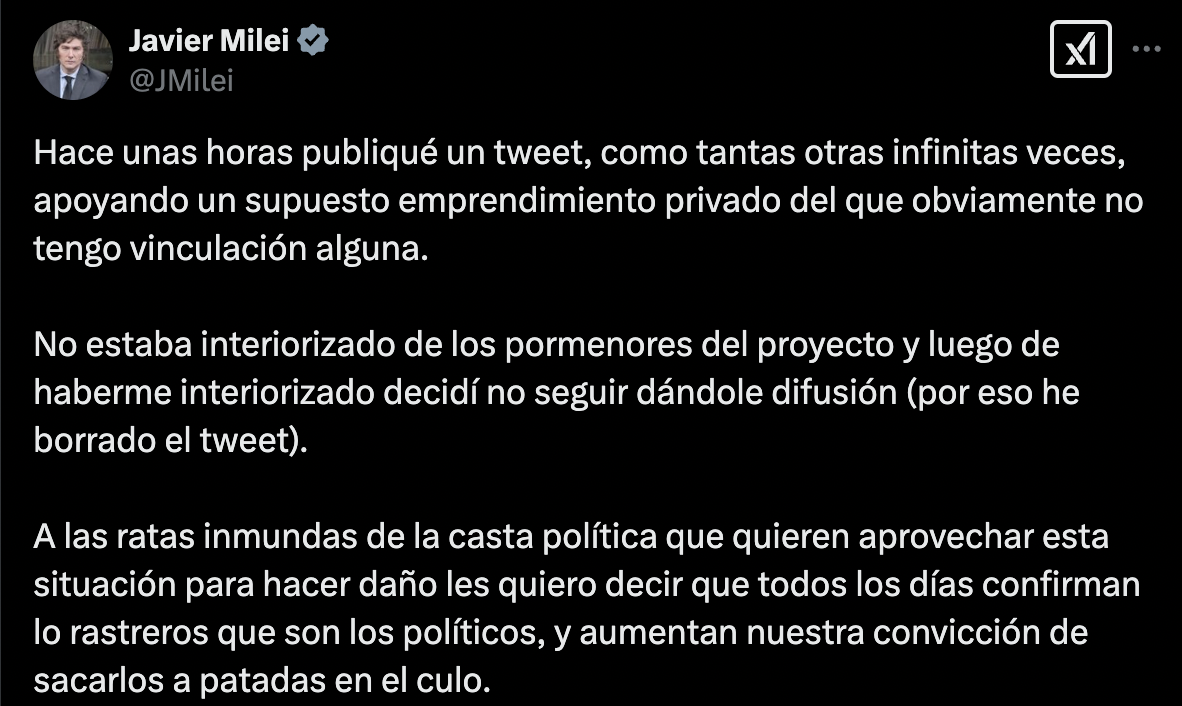

“Dirty Rats” and the President’s Deleted Tweet

After LIBRA’s sharp collapse, President Milei initially lashed out at the organizers, calling them “dirty rats.” According to Milei, he lacked detailed information about the token before publicly endorsing it to his million-strong audience. He later deleted his post supporting LIBRA, explaining that he had allegedly been “misled.”

Nevertheless, several opposition politicians in Argentina accused the president of fraud and even demanded his impeachment. Tensions heightened when it emerged that the development team allegedly withdrew around $87 million through liquidity pools and still controls another $500 million, potentially triggering further price drops.

Causes of the Crash: Manipulation and Lack of Transparency

Analysts note that most LIBRA tokens appear to have been concentrated in a single wallet tied to the project team. This indicates that developers may have artificially pumped the price, then swiftly withdrew a large sum once the coin peaked, triggering a panic sell-off.

Initially, the president promoted the meme coin as a way to fund small businesses in Argentina. However, following the collapse of LIBRA’s value, Milei made several contradictory statements, claiming to have no real connection to the project. Some view this as an attempt to evade responsibility, especially since the president has repeatedly advocated for the expansion of cryptocurrency usage and their integration into government programs.

Impeachment Threat and Investor Fallout

LIBRA’s collapse sparked a major political scandal in Argentina. The opposition demands an investigation into whether the president or his associates profited from the token’s rapid rise and subsequent crash. Although Milei has initiated an inquiry, many see this move as an effort to deflect suspicion from himself.

A significant number of private investors lost money by investing at the token’s peak. This incident once again highlights the risks associated with meme coins and how easily excessive hype and promises from officials can mislead even experienced traders.

In the crypto world, no one should be trusted blindly, even if a project is backed by prominent figures or politicians. Always remember to apply risk management and critical thinking—no lofty promises are worth the loss of your hard-earned funds.

- No comments

Blog

Read our news

Follow our updates to stay informed about the latest news, trends, and analytics in the world of cryptocurrencies.

- 24 June, 2025

Altseason: what is it and how to make money on it

Alt season, or altcoin season, is a phenomenon that attracts special attention from traders and investors. But what is alt season? It is a period when alternative cryptocurrencies, or altcoins, show significant growth, often outperforming Bitcoin in

- 18 June, 2025

What is NFT

Anyone interested in crypto has heard about the concept of NFT many times. But not everyone knows how it works. What is NFT? NFT tokens are digital assets that certify ownership of a collectible, musical piece, or work of art. This abbreviation stan

- 09 June, 2025

Fiat money

Fiat currencies are banknotes issued by the state and guarantee their value. Fiat money in simple terms is ordinary paper or digital money that everyone is used to using to pay for goods and services. It can be a dollar, euro, hryvnia, yen, and so on